Blog

5 Proven Strategies to Drive Lead Generation in Banking

Discover 5 powerful digital tools like missed calls, SMS, WhatsApp, and RCS to boost lead generation for banks. Start growing today!

S

Shelly Prakash

•Revolutionize Banking Leads with These 5 Proven Digital Tactics

If you’re in the banking sector, you’re likely always searching for ways to reach more customers, generate leads, and build lasting relationships. But in today’s digital world, traditional methods don’t cut it anymore. People want speed, convenience, and a personal touch—all things that digital tools can deliver. Let’s dive into five actionable strategies that can help your bank generate more leads and connect with customers on their terms.

Let’s dive into five actionable strategies that can help your bank generate more leads and connect with customers on their terms.

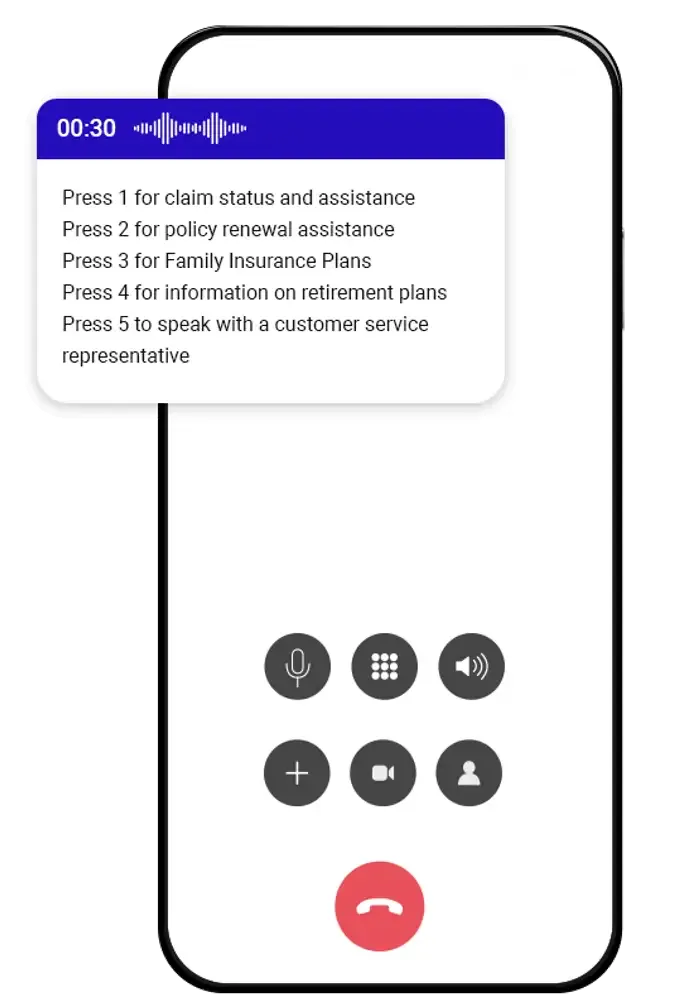

1. Leverage Missed Call Services for Instant Engagement

Have you ever thought about how simple a missed call can be? For your customers, it’s a no-cost, no-hassle way to reach out—and for you, it’s a powerful lead generation tool.

Here’s how it works:

- A customer sees an ad or hears about your service and gives a missed call to a dedicated number.

- You instantly capture their interest and follow up with an SMS or IVR call.

Why it works:

- Customers don’t have to fill out forms or visit a branch.

- It’s cost-free for them, which lowers any hesitation.

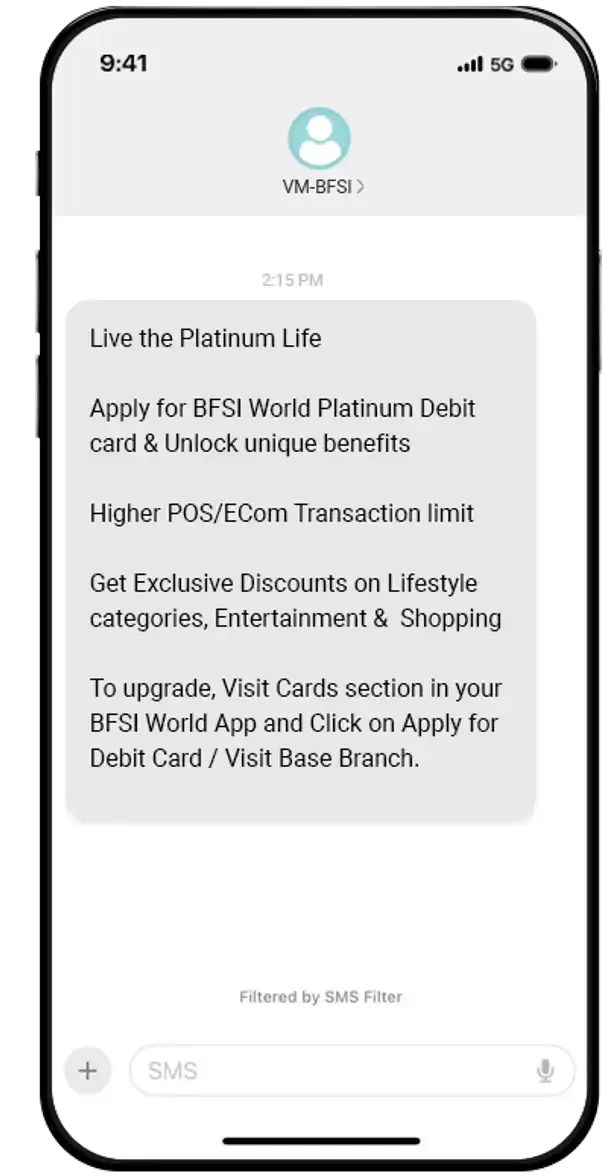

2. Use Bulk SMS Campaigns to Deliver Targeted Offers

When was the last time you ignored a text message? Probably never. That’s the power of SMS: It’s direct, personal, and effective.

Here’s what you can do:

- Segment your audience based on their needs (e.g., existing customers vs. prospects).

- Send personalized messages about credit card upgrades, special loan rates, or account benefits.

- Add a sense of urgency: “Apply by 5 PM today to get a special rate.”

Why it works:

- SMS has a whopping 98% open rate.

- Messages are short and to the point, making them hard to ignore.

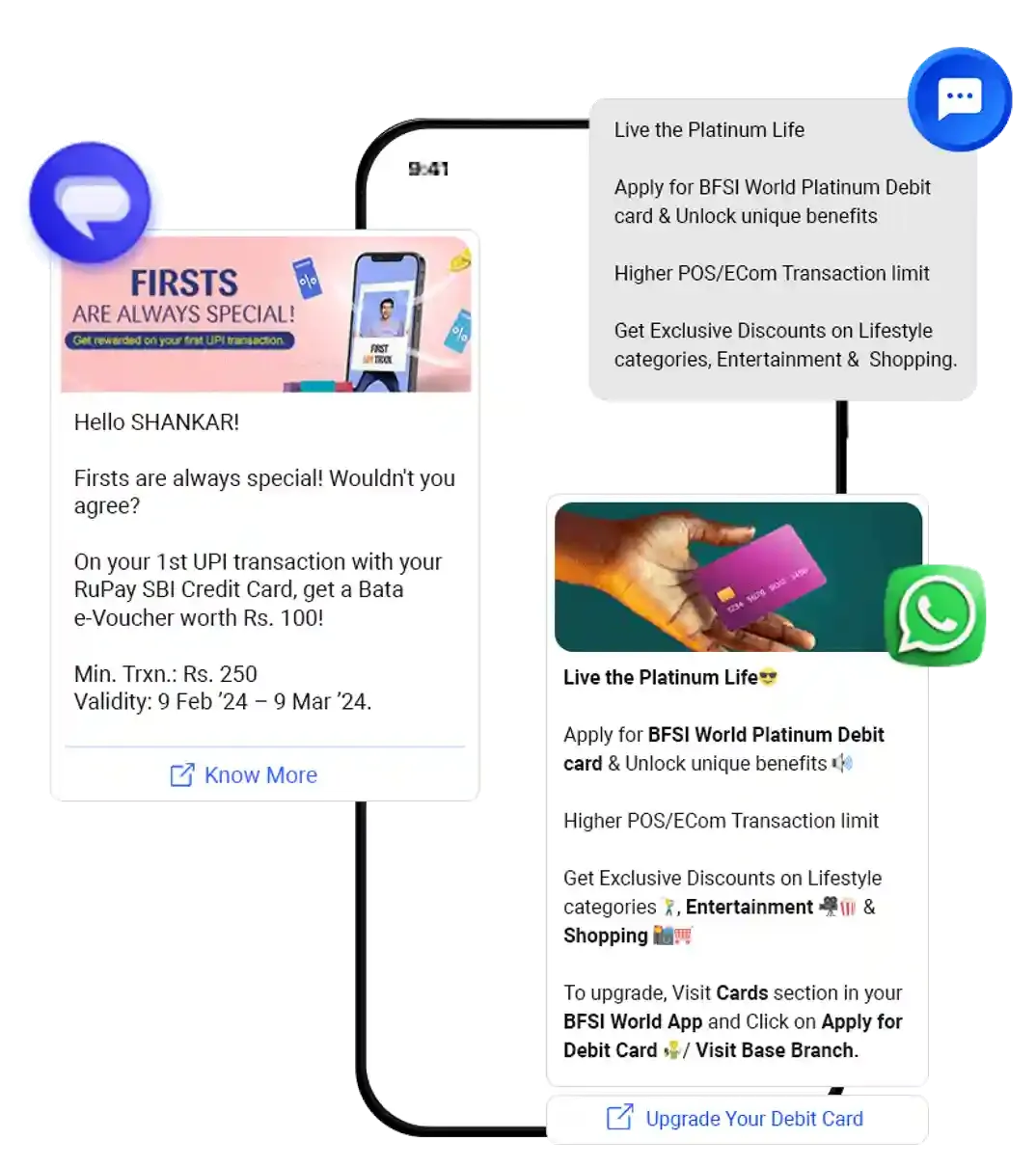

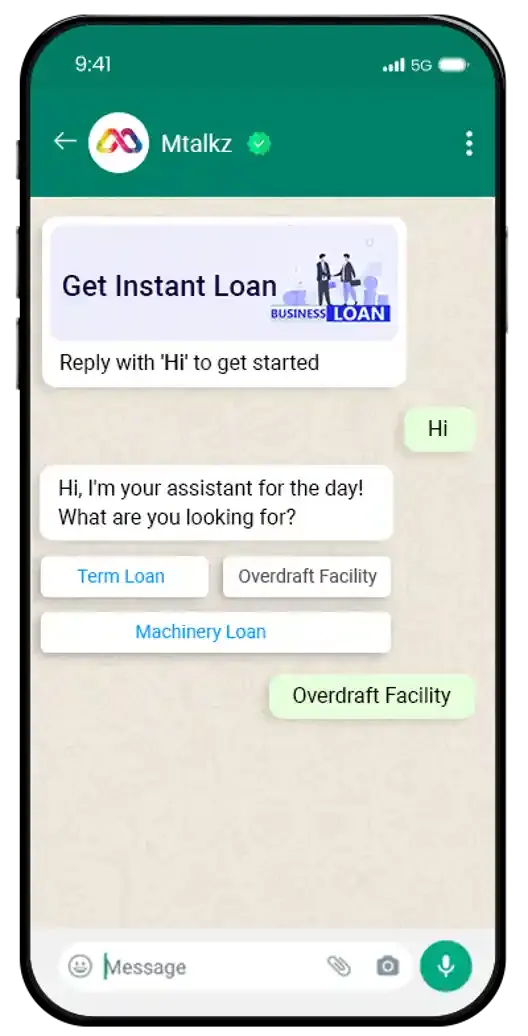

3. Engage Customers on WhatsApp for Personalized Conversations

WhatsApp is more than just a messaging app—it’s a lead generation powerhouse. With over 2 billion users worldwide, it’s where your customers are.

How to make it work for you:

- Use WhatsApp Business API to automate responses and ensure 24/7 availability.

- Send interactive messages: share images, videos, or even documents like account opening forms.

- Use it for reminders, like EMI payments or upcoming offers.

Why it works:

- It’s personal. Customers feel like they’re chatting with a friend rather than a business.

- It’s interactive. You can send quick replies, buttons, and multimedia for a richer experience.

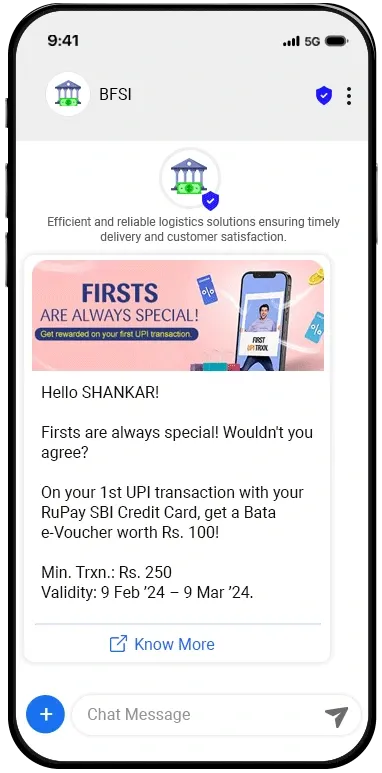

4. Adopt RCS Messaging for Enhanced Lead Engagement

If you’re looking for the next big thing in messaging, RCS (Rich Communication Services) is it. Think of it as SMS 2.0—but with more visuals, interactivity, and engagement.

What you can do with RCS:

- Send messages with images, buttons, and carousels showcasing your services.

- Include clickable buttons for instant actions like “Apply Now” or “Schedule a Callback.”

- Use it for customer education: share loan calculators or FAQs.

Why it works:

- It’s visually appealing, making your offers stand out.

- It’s interactive, so customers can take action right within the message.

5. Integrate Digital Tools with Your CRM for Smarter Lead Management

Now that you have leads coming in from missed calls, SMS, WhatsApp, and RCS, how do you manage them all? That’s where a CRM (Customer Relationship Management) system comes in.Here’s how to get the most out of it:

- Sync all your lead data into a single platform for a complete view of your prospects.

- Use analytics to identify high-value leads and prioritize follow-ups.

- Automate reminders and follow-ups for a seamless lead nurturing process.

Why it works:

- Centralized data means no lead gets lost in the shuffle.

- Automated workflows save time and improve efficiency.

Key Metrics to Measure Success

Once you’ve implemented these strategies, it’s time to measure their impact. Here are the metrics to watch:- Conversion rates from each channel (missed calls, SMS, WhatsApp, RCS).

- Engagement metrics like open rates, click-through rates, and response times.

- ROI on campaigns and cost-per-lead.